My last blog was regarding our decision to purchase another home in The Parkways at Maui Lani with the intention to rent the property.

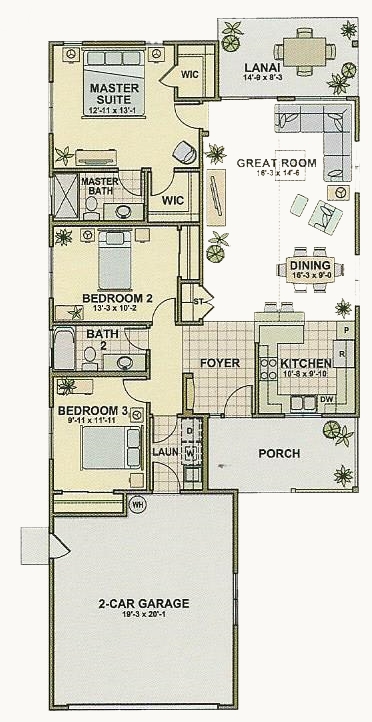

The home we are purchasing is the P-1, or Hapuna model. It is currently under construction.

After reading my last blog, an avid fan of my blogs commented and asked the classic question, “Why? It is great you decided, but what motivated you to purchase?”

That is a great question that presents an opportunity to share the criteria behind our decision-making. Everyone is different. Everyone has different wants and needs, and different budgets in which they can obtain those wants and needs. In our case, we are looking for a good investment that will assist us with our goal of a comfortable retirement. We want property that will appreciate and produce revenue in the form of positive cash flow.

Some of our specific guidelines are:

1) We look for properties where we can see a rate of appreciation of 10% or more per year for the last two years. This is accomplished by studying the comparable sales in the area.

2) We look for scenarios that will provide $500 or more per month in positive cash flow. This is determined by the rental income and the size of the down payment, as well as other factors such as homeowner association fees, property taxes, etc. The higher the down payment, the lower the mortgage payment, which means lower principle and interest mortgage payments per month. Lower HOA fees are also helpful in increasing the positive cash flow.

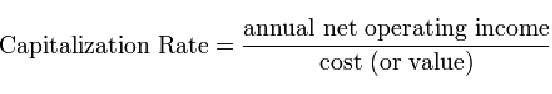

3) We look at scenarios where the capitalization rate exceeds 5%. This is determined by dividing the net rent per year by the purchase price. Mortgage payments are not taken into consideration with cap rate calculations.

Here is the rationale of this particular transaction:

In August 2015, the base price for a P-3 Makena model was $539,000. If that plan was being offered in Phase 3, Release 4, the base price would be approximately $675,000. That represents appreciation of around $136,000, which translates to 25% in just under two years, which means the rate of appreciation for this area is around 12-13% per year. That level of appreciation works for us.

The next thing to take into consideration is rental income. This new home will rent for $3,000 to $3,200 per month, and the positive cash flow will be around $600 per month. The capitalization rate will be approximately 5.4%; the positive cash flow and the capitalization rate on this property meet our requirements.

There are other factors that we have used in the past; an example being the positive cash flow is equal or greater than 50% of the principle and interest portion of the mortgage payment. We chose to not require that metric in this case.

Again, there are many ways to accomplish purchasing rental property here on Maui. One method that is preferred by many buyers is to purchase distressed property and fix it up. We choose to purchase new from the builder as much as possible. This can limit the inventory you have to choose from, but you end up with a brand new home and a builder’s warranty. A brand new home is appealing to prospective tenants. Also, in a phased development, you may see appreciation with price increases per phase.

As with all of my blogs, I want to advise you to obtain advice from an accountant or a financial advisor. What works for us may not work for everyone.

More Information

Please feel free to contact me regarding buying or selling real estate here on Maui. I look forward to discussing your personal goals, wants, and needs regarding property here on our beautiful island.

Aloha,

Rick Wyffels, Realtor-Broker, MS, RSPS (Resort and Second-Home Property Specialist)

808-495-6092

RickWyffels@HawaiiLife.com

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.