Time for a Financial Fast!

A financial fast is an opportunity to improve your skills as a steward of your income. Several years ago I participated in a church wide financial fast. The fast was guided by Michelle Singletary’s book “The 21-Day Financial Fast: Your Path to Financial Peace and Freedom.” For 21 days, I was going to limit, review, and restrict my spending. My motivation was two fold, I had a good salary but I wasn’t building the stability I wanted. Most importantly I wanted to strengthen my relationship with Christ by sacrificing and exercising discipline similar to a food fast. I made a few false assumptions about my spending habits. The fast was an eye-opening experience that I would recommend for anyone regardless of income, age, or religion.

Think you have mastered your finances? Prove it!

Whether it’s 7 or 21 days, there is an opportunity to create self-awareness. What is your relationship to money? Is it a means to an end or is it the goal? My relationship with money was shaped, like most people, in my youth. We didn’t have a lot of money so as an adult my very basic goal was to secure self-sufficiency. It seems like a positive goal, but underneath it all, fear was my motivator. Fear that I would not have all that I needed to enjoy a happy and fulfilling life. Fear is not the best motivator, I wanted to strive for a positive outcome versus just avoiding a negative one.

Does your net worth impact your self-worth? Do you judge others on how much money they appear to have? Your belief system about money and your personal vices can be explored through this financial fast.

Planning for the Future, Courageously

Many of the financial decisions we make now will impact our future. Living courageously includes taking calculated risks, challenging ourselves, and getting out of our comfort zone. You can live courageously without making reckless or overindulgent choices with money.

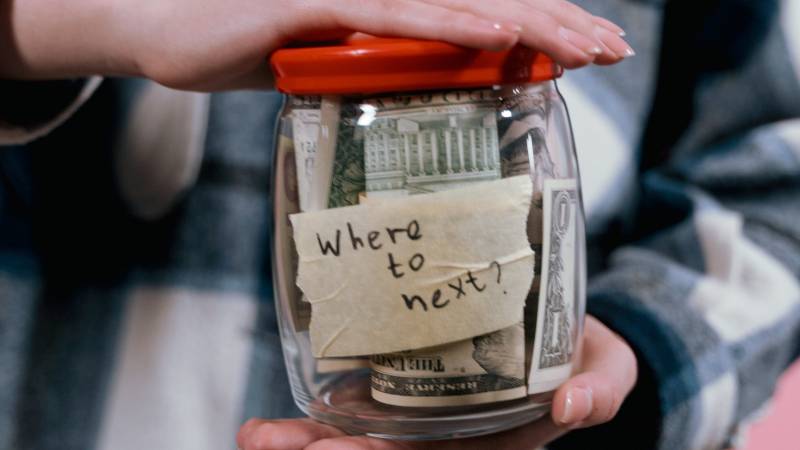

Are you spending, saving, and investing for the future you envision for yourself? Can you afford to raise children? Will you be able to retire comfortably? Will you vacation or travel regularly? Planning to buy a home in Hawaii?

Prior to my first financial fast, I wanted to buy a home. I was trying to save for a down payment which always seemed to dwindle after each emergency expense. I was saving without a plan. The fast changed all that and gave me a financial blueprint. I stuck with it and just one year after the fast, I saved more money than I ever had before. I was able to take my modest savings and meet with a real estate agent. I honestly thought it would be years before I could be a homeowner.

Pursuing a Debt Free Life

I know the idea of living without debt seems impossible these days especially with student loans looming. And there are ways to use debt strategically to generate wealth. Most of us are not using credit in this manner. Debt has become a burden for some, grabbing at every paycheck, and dampening the goal of financial stability. There is a unique sense of doom that occurs when you purchase on a credit card that you are trying to pay off. You may not be in debt because of spending habits. Consider a credit repair program or consult a financial advisor in your pursuit of financial freedom. You can decide when, where, and how your money is spent if it is not already owed to someone else.

Preparing for Your Increase $$$

We should all be expecting to see a financial increase this year. Embrace a spirit of great expectations. Maybe you will earn more money, reduce your expenses, or receive a large sum of cash. You should be prepared for this increase and utilize the “extra” cash to meet other goals. It is common to upgrade your lifestyle with a pay raise. This may not reap the best long-term benefit for you. Do not assume budgeting is just for the rich. If you are a good steward over a little, you will be a good steward over a lot. You can keep more of your income. You can enjoy what you have, brace for what you will receive, while showing a greater appreciation for what you have earned.

Lastly, you have goals that do not include simply “to work and save.” Discover how to enjoy your money now without neglecting your future.

You’ve decided to complete a financial fast, great!

I strongly recommend you purchase and follow the guidelines in the book. For 21 days, you will read and complete the activities. Below is a summary of the fast.

- Find a partner(s). Solicit a friend to join you on this journey. You are more likely to finish the fast if you have someone to encourage you and hold you accountable to your commitment.

- Cash is King. Refrain from using any cards….. gift, credit, debt, or otherwise. You need to feel and see the money leaving your hands. This does not include any prearranged bills debited from your accounts.

- Refrain from participating in any social or leisure activities that are not free. Your money during the fast will be used for necessities only. You will discover what you have deemed to be a need or a want.

- Create a realistic and detailed budget. There are many options for creating a budget. Find one that suits your needs. Avoid budgeting in general terms, budget down to the dollar so all of your income is accounted.

- Repeat the fast. You determine how often it is necessary. I needed to reinforce the lessons learned through the fast. A simpler reminder that my income, small or great, is a gift that I cherish through my behavior. Make an annual commitment to financial fast.

As you complete this fast, you may discover that you are financially prepared to meet your real estate goal. Maybe you’ll spend the next year preparing. Contact me, a trusted real estate agent, to assist you.

Elizabeth Curran

January 26, 2022

I wish I came upon this article years ago. I am almost 70 and still working. I live in fear over money and my future.

I am looking forward to ordering this book and following it … probably for the rest of my life. Thank you , Elizabeth