As real estate agents, we wear many hats. One of those hats is educating our sellers and buyers about how things are done here on the Big Island, especially regarding fees and closing costs. Not everything is like a mainland property purchase or sale.

In this article, my focus is on closing costs and conveyance fees. A seller needs to understand these fees, but a little knowledge about them can also assist a buyer with negotiations.

What Are Closing Costs?

Closing costs are fees paid when a home is sold, and buyers and sellers pay their respective parts. As agents, we can use our experience to estimate your fees when selling your Hawaii home, but our hands are pretty tied regarding items such as HOA transfer fees, pro-rated HOA fees, property taxes, loan fees, and appraisal fees. Each person’s purchase is unique, and the buyer and seller sides differ, so the total amount varies from home to home.

To get a little more exact, the title company or escrow officers can provide both buyer and seller with an estimate. Please note these estimates don’t include pro-rated fees as stated above. Buyers would best speak to their lender regarding their loan and associated fees.

Who Pays What for Closing Costs on the Big Island

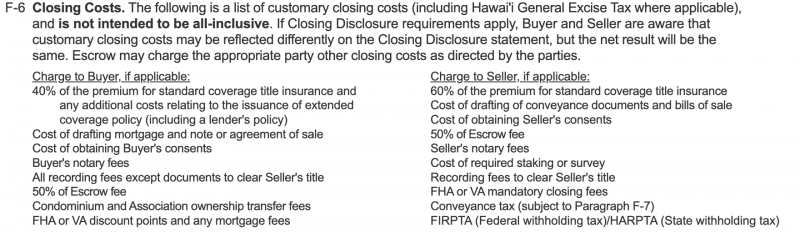

You will see on the purchase contract section F-6, which details what the buyer and seller each pay for closing costs.

- The escrow fee is split 50% between the buyer and seller

- Buyer pays 40% of title insurance

- Seller pays 60 % of title insurance

- Each side pays their own notary fees

- Seller pays conveyance tax

- Seller pays HARPA/FIRTA taxes as applicable

- Buyer pays all loan fees

I’ve attached a screenshot of those customary closing costs. Please note that there may be other fees not shown here, and again, the costs of selling a home in Hawaii will differ for each transaction.

What Is a Conveyance Fee?

The State of Hawaii imposes a tax on sellers when a piece of real estate is transferred from one party to another, known as conveyance.

How Can a Seller Save Money on Conveyance Fees?

When the seller reviews the purchase contract, one very important section the seller should always look at is F-7. This section, F-7 of the purchase contract, shows how the buyer will take the title.

The buyer has two choices:

- Take title as a primary resident of the State of Hawaii OR

- Purchase the property as a non-resident (so they have a principal residence elsewhere)

The buyer’s choice can affect the seller’s conveyance fees, and the purchase price factors in, too! Understanding how a buyer will take the title will show the seller how much they will pay in conveyance fees when selling their Big Island home. If the buyer purchases the home/condo in Hawaii as a second home or investment property, the seller will pay a higher conveyance fee.

For example, if your home is priced at $600,000 and the buyer is purchasing the home as a non-resident (The conveyance tax rate is .0015), the seller will be an extra $300 more than if the buyer was purchasing as a resident. As you see below, the conveyance fees increase dramatically as the sales price increases.

Conveyance Tax Rate:

| If the amount is: | Non-Resident | Resident of Hawaii

(ELIGIBLE for a county real property tax homeowner’s exemption) |

| Less than $600,000

|

.0015 | .0010 |

| $600,000 or more than but less than $1,000,000

|

.0025 | .0020 |

| $1,000,000 or more than but less than $2,000,000

|

.0040 | .0030 |

| $2,000,000 or more than but less than $4,000,000

|

.0060 | .0050 |

| $4,000,000 or more than but less than $6,000,000

|

.0085 | .0070 |

| $6,000,000 or more than but less than $10,000,000

|

.0110 | .0090 |

| $10,000,000 or more

|

.0125 | .0100 |

If you’re considering listing your home and want to understand better the costs associated with selling in Hawaii, give me a call, and I can walk you through how the closing costs and fees here on the Big Island can come into play in your scenario. My years of experience as a real estate agent in Hawaii can help you navigate the selling process by looking at your costs before you even list your home.

With Aloha,

Leeana

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.