Whatʻs Next for Short-Term Rentals on Hawaii Island? Meet TAR

My past blog posts on Big Island short-term vacation rental registration will become outdated in 2023. I have been saying for a while to watch for new regulations. On November 21st, two Hawaii Island County Council members, together with the Planning Director and Deputy Director, hosted a ZOOM call to outline the proposed changes as a first step in gathering community feedback. At only a few days’ notice, almost 500 constituents logged on.

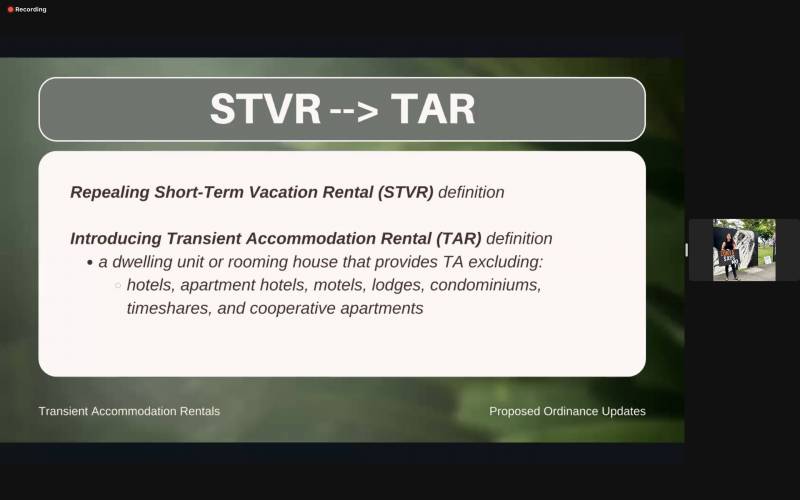

Forget about Short-Term Vacation Rental or STVR. The new ordinance aligns with the state in calling them Transient Accommodation Rentals or TAR

Licensing Proposed for Hosted Short-Term Vacation Rentals (Transient Accommodation Rentals)

The meeting was intended to be the first in a series of opportunities for Big Island residents to learn about proposed legislation. The purposes of the bill will be to align Hawaiiʻi County regulations with State statutes (starting with the shift in language to use the term Transient Accommodations Rental or “TAR”); address hosted rentals (the 2018 regulations were for unhosted rentals only); clarify portions of the existing registrations process that need improvement; and provide for better enforcement.

Here is a link to the draft bill: Proposed 2023 Amendments regarding Transient Accommodation Rentals

Following additional community input sessions in January 2023, the bill will be introduced in County Council committee and hearings held by the Windward and Leeward Hawaii County Planning Commissions. After it is finalized in committee, it still must pass two readings in full County Council before being signed into law by the mayor.

Whatever you read below in this blog post is likely to change over the course of 2023, so please note the information is accurate as of November 2022 and subject to change thereafter!

Essential Proposed Provisions Regarding Hosted Transient Accommodation Rentals on Hawaiʻi Island

The County will consider any host advertising online a TAR — per the proposed hosted rental bill, lack of registration results in a $10,000 fine

The State of Hawaiʻi defines a long-term rental as 180 days. Shorter rentals under contracts subject to landlord-tenant code, or when a long-term rental automatically goes month-to-month at the end of the initial term, are not considered transient accommodations. Transient accommodations are subject to two state taxes: Transient Accommodations Tax as well as General Excise Tax.

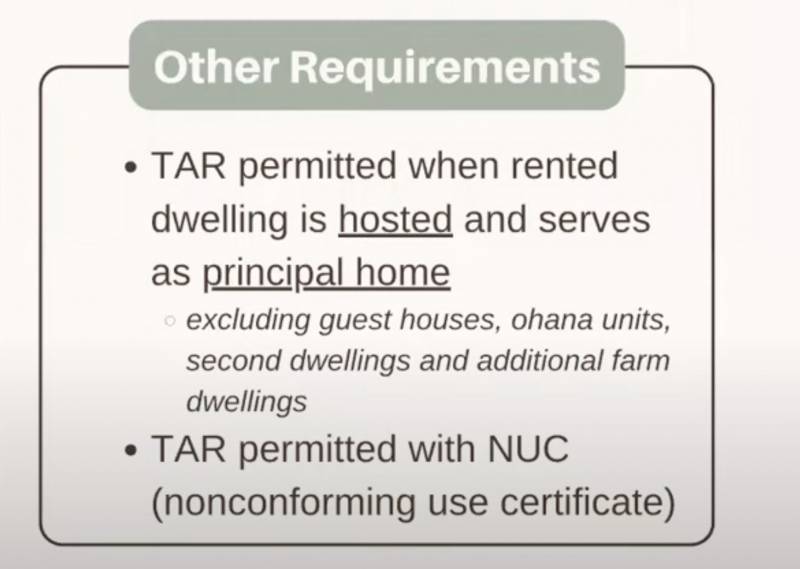

The earlier ordinance addressed registration for unhosted short-term rentals – meaning vacation homes where the owner or operator does not live on site. While some hosted, as some unhosted, rentals need only register as they fall into qualifying categories or zoning, the most controversial part of the new bill is likely to be the process for existing rentals outside of qualifying zoning to obtain a non-conforming use certificate.

Most requirements for being “grandfathered in” via a nonconforming use certificate look very similar to those for unhosted rentals: appropriate zoning, fully permitted construction, already being in operation prior to the date of the bill, and having paid taxes on past rentals. What will likely raise alarm bells and affect a majority of existing hosted vacation rentals is the language above: excluding guest houses, ohana units, second dwellings and additional farm dwellings.

Although the commentary in the ZOOM chat box was extremely negative, and I expect that will be the same at the public hearings, as someone living in a rural community where very little agriculture is done on agriculturally zoned properties and many structures permitted as additional farm dwellings intended to house workers are instead housing tourists, I might have been one of the few on the call who saw benefits to the changes.

Some Hosted Rental Exceptions to the Transient Accommodation Rental Regime

A few situations in which this new regulatory framework would not apply to you:

- Your property is in residential zoning, you rent no more than five rooms, you reside on the premises, and opt to obtain a bed-and-breakfast license instead. You are then covered under existing provisions of Chapter 25 of the zoning code.

- You go away for an extended vacation and rent your primary residence while you are away. This is called a “temporary homestay.” To qualify you must occupy your home for over 300 days a year and rent it for less than 30 days in total.

How to Give Feedback on the Proposed Changes

After you have read the draft bill, you can provide comments with this form: Feedback on Proposed Changes to Hawaii County Transient Accommodation Regulations.

You can also watch the entire presentation — or stay tuned and I will post additional community meeting dates as they are set.

Teri Takata

November 28, 2022

Thank you Beth. This is the most detailed explanation I have seen!

Rick

December 5, 2022

Hi Beth thanks this is the best explanation so far. I find the bill quite over reaching and see many issues. The “guest house” issue in particular. Also that persons with a real estate license can have more than 1 rental. The worst is that the council thinks this will add long term housing options. It did not on oahu so why work here. People would consider creating more long term rentals if the owners had more rights but when the tenant decides to just stop paying it is very difficult to get them out and will cost the owner thousands. I find it crazy that a tenant can just no pay the owner but I still have to pay my mortgage all the while they get a free ride. Lastly this all sounds like a power grab written by Hilton and the other big businesses. They will never close shop here no matter how many Airbnb’s people have here the difference is there money funnels directly out of the community whereas hosted rentals owned by residents keep theirs right here in Hawaii county.

This bill is not gonna pass quietly!

John

December 28, 2022

Thanks Beth, Is there a list of permitted STVRs on the Big Island?

Beth Robinson

December 29, 2022

> Hi John, you can check with the County to find out if a property has its STVR license.

Shawn

March 1, 2023

Beth

Thanks for the update. Please keep me in your updates. I have had a STVR for a number of years. I pay out a great deal to local people for cleaning, landscaping, tree service, pool service, repairs etc. In the tune of $3,500 a month plus all the fees and taxes. It’s a great deal for all involved. I understand local property owner’s concerns about noise etc and those concerns should be paramount and strictly enforced. I don’t allow any of that and the threat of large deposit confiscation has made the issue non existent.

With the lack of enforcement on removing deadbeat renters , it’s no wonder investors are Leary of building single family or similar in Hawaii. The large Hotel chains are fighting back with these new STVR regulations and using the “native Hawaiian” moniker as justification- but it’s really about control and money.