Long-Term vs. Short-Term Rentals

Owning rental property on Maui is something many people dream about. This article will discuss various scenarios where one can “take the plunge” into the Maui rental market, armed with knowledge that will help with good decision making. We will look at Long-Term Rentals and Short-Term Rentals.

Long-Term Rental Of Condos

Long-Term Defined

By definition, “Long-Term” means a rental with a minimum rental term of 6 months. If the condominium complex is not zoned for Short-Term, it is Long-Term by default.

If a condominium complex is zoned for Long-Term rentals, the Homeowner’s Association is not allowed to permit owners to rent their units on a Short-Term basis. That would be a County of Maui violation and subject to potentially heavy fines.

Consistency

With Long-Term Rentals, the owner/manager knows what the income will be every month of the rental term, and what the expenses are for each month of the rental term. This provides ease in forecasting and budgeting. Also, if you have a tenant on a one year lease, you have 100% occupancy for that year.

Utilities

Generally, the tenant in a Long-Term lease pays for their own utilities such as electric, cable, telephone, water, and sewer, although there are instances where certain utilities are included in the monthly rent.

Using Your Property

If an owner is looking to purchase a rental property on Maui and book time for themselves during the year, a bit more planning is involved with Long-Term rentals. If you own a condo that is leased, you would arrange to stay there between the time the current lease ends and the next lease begins. As an example, some owners own property other than on Maui, and they stay at the other property for 6 months and then stay in the Maui property for 6 months. These owners are looking for tenants that will agree to a 6 month lease.

Another example is where an owner will stay in the unit upon the end of a lease term…maybe 1-3 months and then rent the unit upon their departure. Any combination is permitted, as long as the lease term is a minimum of 6 months on a long-term property.

Financing

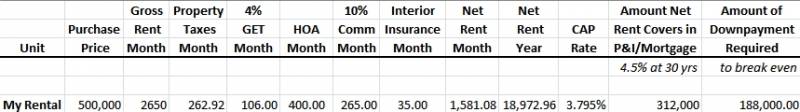

For many lenders, the minimum down payment for a long-term rental property is 25% down on an “Investor” loan. When considering the down payment amount, it might be helpful to know the “breakeven” amount of positive cash flow. Consider the following spreadsheet:

The above example shows a scenario where the down payment of $188,000 would be enough to allow the net rent to be enough to pay the mortgage amount and result in a neutral cash flow.

If the minimum down-payment required by a lender is 25%, the down payment would be $125,000, and the above example would result in negative cash flow. This may justify coming in with a higher down-payment than what is required by a lender for an investment property.

Review Of Other Items In The Spread Sheet:

Property Taxes

Currently, long-term rental properties are classified as “B. Apartment,” and the current tax rate is $6.31 per thousand dollars of assessed value.

GET

GET stands for “General Excise Tax.” Currently, this tax equals 4.00% of the gross revenue of rent income.

HOA

This stands for “Home Owners Association.” Sometimes this is seen as AOAO, which stands for “Association of Apartment Owners.” This is the amount of the monthly maintenance fee charged by condominium and subdivision associations.

10% Commission

An amount you can expect to be charged by a Long-Term Rental Management Team. If you live on Maui, you have the option to manage the unit on your own. If you live off island, you are required to have an “On-Island Contact Person.” This is someone that the tenant can call in the event of a problem. It is generally advised that if you live off island, it is a good idea to enlist the services of a management professional. Well worth the money. They take care of advertising, vetting the applicants, selecting a tenant, collecting the rent, forwarding the net rent to the owner, and checking out the tenant at the end of the lease, and verifying the condition of the unit.

Interior Insurance

Since condominium association fees generally include the premium for Home Owner’s Insurance, it is a good idea to obtain Content, or, Interior Insurance. This is coverage for things in the unit that you own, such as appliances, furniture, etc.

Cap Rate

This refers to Capitalization Rate, which is the return on your investment in terms of rental income. It is calculated by taking the net yearly rent and dividing it by the purchase price. (Mortgage payments are not included in calculating net rent for Cap Rate).

Short-Term Rental Of Condos

Short-Term Defined

By definition, “Short-Term” means a rental with less than a rental term of 6 months. These are generally rental units used for vacations, and are commonly booked through Airbnb, VRBO, and travel agents. Short-Term rentals are also allowed to be rented as long-term rentals.

Consistency

With Short-Term Rentals, the owner/manager knows what the income will be every month based on reservations received for the unit. Expenses will vary based on occupancy and rental income. Forecasting and budgeting are approached more from an annual basis rather than a monthly basis. Income can be higher than a long-term rental, but expenses can be higher, and occupancy can range from 75% to 90% for the year. Therefore, short-term rentals are possibly less consistent than long-term rentals in some regards.

Utilities

Generally, the owner of a Short-Term unit pays for the utilities such as electric, cable, telephone, water, and sewer.

Using Your Property

Many owners enjoy the opportunity of booking themselves in their own unit when coming to Maui for a visit. Owner’s use of a short-term property may have certain rules and regulations that need to be taken into consideration, so it is best to check with your CPA and/or attorney.

Financing

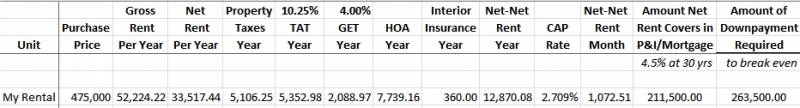

For many lenders, the minimum down payment for a short-term rental property can be between 25% and 30% and even higher, depending on the particular complex. When considering the down payment amount, it might be helpful to know the “breakeven” amount of positive cash flow. Keep in mind that generally short-term rental properties are evaluated on an annual basis, not a monthly basis as with long-term rental properties. Consider the following spreadsheet:

The above example shows a scenario where the down payment of $263,500 would be enough to allow the net rent to be enough to pay the mortgage amount and result in a neutral cash flow. This down payment would represent approximately 55% of the purchase price.

Review Of Other Items In The Spread Sheet:

Property Taxes

Currently, short-term rental properties are classified as “K. Short Term Rental,” and the current tax rate is $10.75 per thousand dollars of assessed value.

TAT

TAT Stands for “Transient Accommodation Tax.” Currently, this tax equals 10.25% of the gross revenue of rent income.

GET

GET stands for “General Excise Tax.” Currently, this tax equals 4.00% of the gross revenue of rent income.

HOA

This stands for “Home Owners Association.” Sometimes this is seen as AOAO, which stands for “Association of Apartment Owners.” This is the amount of the monthly maintenance fee charged by condominium and subdivision associations.

20%-40% Commission

An amount you can expect to be charged by a Short-Term Rental Management Team. This would be included in the difference between the Gross Rent Per Year and the Net Rent Per Year. If you live on Maui, you have the option to manage the unit on your own. If you live off island, you are required to have an “On-Island Contact Person.” This is someone that the tenant can call in the event of a problem. It is generally advised that if you live off island, it is a good idea to enlist the services of a management professional. Well worth the money. They take care of advertising, vetting the applicants, selecting a tenant, collecting the rent, forwarding the net rent to the owner, and checking out the tenant at the end of the lease, and verifying the condition of the unit.

Interior Insurance

Since condominium association fees generally include the premium for Home Owner’s Insurance, it is a good idea to obtain Content, or, Interior Insurance. This is coverage for things in the unit that you own, such as appliances, furniture, etc.

Cap Rate

This refers to Capitalization Rate, which is the return on your investment in terms of rental income. It is calculated by taking the net yearly rent and dividing it by the purchase price. (Mortgage payments are not included in calculating net rent for Cap Rate).

For more information regarding Real Estate on Maui, please feel free to contact me!

![]()

Rick

Rick Wyffels, Realtor-Broker, RB-21621

MS, (Master of Science)

RSPS (Resort and Second-Home Property Specialist)

ABR (Accredited Buyer’s Representative)

808-495-6092

RickWyffels@HawaiiLife.com

Holly Gutfreund

December 17, 2020

Thank you for the article anything extra evolved if we are Canadian not Americans? We have been saving for this is there a starter range to look? at we find listing hard to get all of the additional fees to see the total cost Is there a listing site that included all that or would an agent keep an eye out for ones that we could afford. We have 5 year until we are mortgage free and have no other debt

Mykeeb33

November 22, 2021

Numbers will need to be adjusted some as Maui County has added its own Transient Accommodation Tax of 3% on short turn Rentals after 11/1/2021. …Basically, 17.4167% total rate on gross income. (nightly rate, checking fee, cleaning fee, resort fee, etc).