Buying Maui Real Estate: What to Expect During Escrow & Closing | #3 in Our Maui Property Ownership FAQ Series

You’ve searched the Maui homes and condos for sale, found a property you love, and made an offer that’s been accepted – now it’s time for escrow and closing! Here are some of the questions you might have as a buyer, along with answers that will help you feel prepared along the way.

Q: What exactly is escrow?

A: The escrow process takes place between a seller’s acceptance of a buyer’s offer and the closing of the sale. An escrow officer serves as a neutral third party who makes sure everyone follows through with the terms of the sale and the transaction is carried out properly. Specifically, the escrow officer:

• Receives the earnest money from the buyer

• Investigates the status of the title to the property

• Prorates taxes, interest, insurance, rents, etc.

• Arranges for the transfer deed

• Follows the lender’s instructions for closing

• Receives purchase funds from the buyer/their lender

• Arranges for the recording of the deed

• Disburses funds

• Issues title insurance

Q: In general, what closing costs should I expect?

A: Based on data compiled by ClosingCorp, buyers in Hawaii pay an average of 1.02% to 1.19% of the sales price in closing costs. Keep in mind that some closing costs can be negotiated. But typically, in addition to earnest money and a down payment, the buyer might expect to be responsible for:

- Costs associated with financing (if applicable), including a loan origination fee, appraisal fee, credit report fee, and document preparation fees

- 40% of the premium for title insurance

- A home inspection

- Prorated property taxes

- Homeowners’ insurance

- Condo/homeowners association ownership transfer fees

- 50% of the escrow fee

- Recording fees

- Notary fees

Typically, the seller might expect to be responsible for:

- The drafting of conveyance documents and bills of sale

- 60% of the premium for title insurance

- The cost of any required survey or staking

- 50% of the escrow fee

- Recording fees to clear the title

- Conveyance tax, FIRPTA, and HARPTA

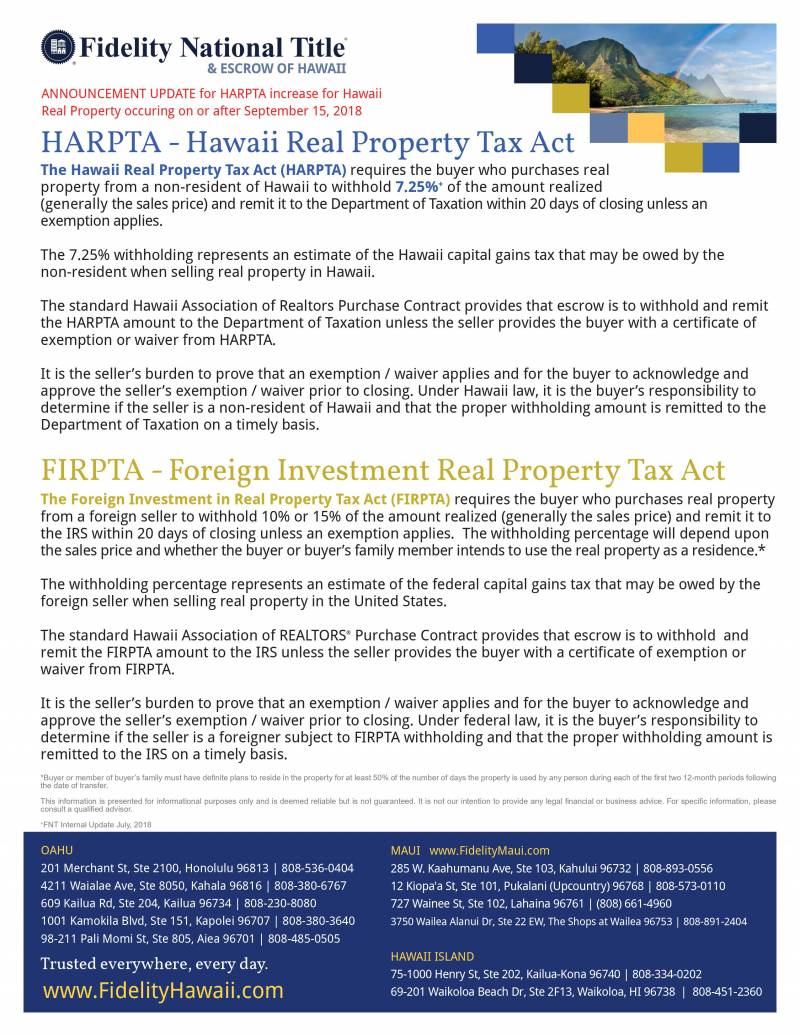

Q: What are FIRPTA and HARPTA?

A: The Foreign Investment in Real Property Tax Act (FIRPTA) requires that if a buyer purchases a property from a foreign seller, a percentage of the sales price is withheld and remitted to the IRS within 20 days of closing (as an estimate of the capital gains tax the seller will owe). Whether the withholding percentage is 10% or 15% depends upon the sales price and whether the property will be used as the buyer’s residence.

It is the buyer’s responsibility to ensure that the FIRPTA amount is withheld if the seller is a foreign person subject to the tax. The standard purchase contract in Hawaii includes a provision for FIRPTA withholding during escrow unless the seller provides a certificate of exemption.

Likewise, the Hawaii Real Property Tax Act (HARPTA) requires that if a buyer purchases a property from a non-resident of Hawaii, 7.25% of the sales price is withheld and remitted to the Hawaii Department of Taxation within 20 days of closing (again, as an estimate of the capital gains tax the seller will owe). As with FIRPTA, the standard Hawaii purchase contract includes a provision for HARPTA withholding unless the seller proves that an exemption/waiver applies.

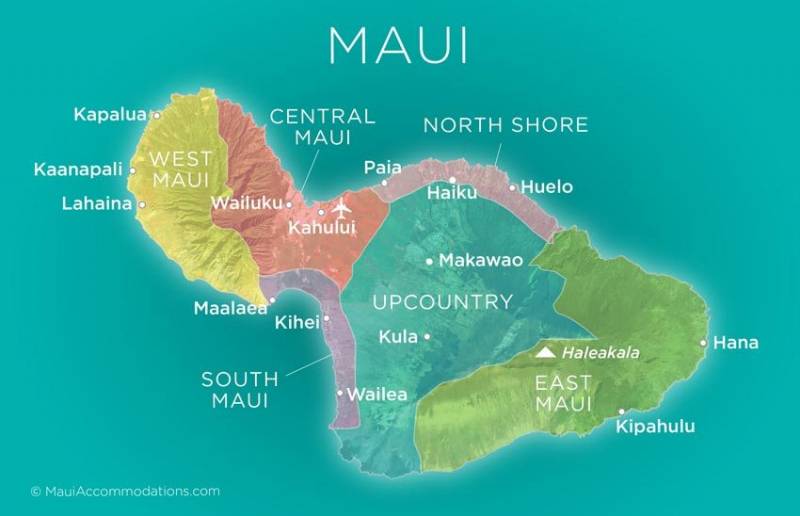

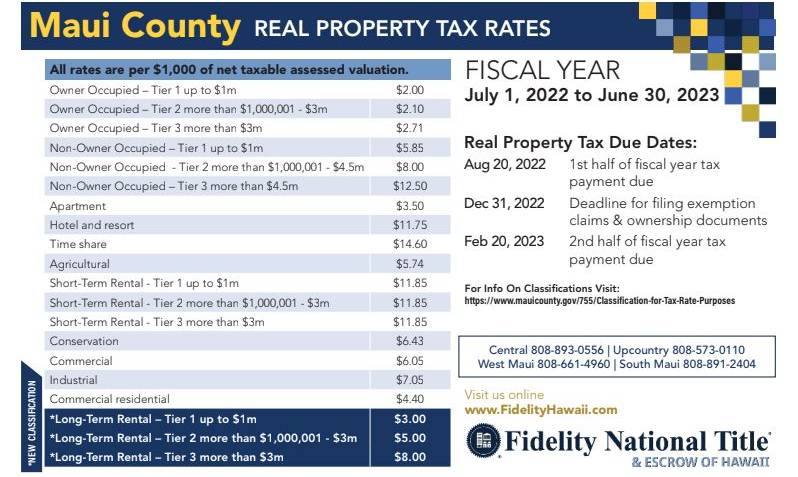

Q: What should I expect when it comes to property taxes?

A: Maui County has some of the lowest property taxes in the nation. And in fact, in May 2022, a decrease in property taxes was announced for most property owners who live in their Maui homes! The county assesses the value of all properties annually and then establishes rates for the upcoming fiscal year (which runs from July 1 through June 30). Here’s a look at our current rates:

Escrow and closing may seem complicated at first glance, but an experienced real estate professional can guide you through a smooth transaction. Contact me today if you have any other questions about the process!

Leslie Mackenzie Smith, REALTOR(S), RS-42147

More Maui Property Ownership FAQs:

Buying Maui Real Estate: How to Make Sure You’re Ready

Choosing the Best Property Management Option for Your Maui Vacation Rental

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.