I have had the opportunity to serve many investors purchasing vacation rental properties in West Hawai’i. As the market seems to be shifting ever-so-slightly, I’m hearing more concern over whether the market is still favorable for investors. With the hike in interest rates and years of historic price appreciation, the concern is warranted. In my experience, when norms are disrupted, most instinctively freeze so as to look around and get their bearings. A 3% rate hike in few months will certainly do that!

Here are 3 significant indicators that suggest now is still a great time to invest in a vacation rental property.

Forecasted Tourism Growth

Tourism has rebounded strongly in the last couple of years coming out of the 2020 shutdown. According to the State of Hawai’i’s Department of Business, Economic Development & Tourism, we still have room to grow to reach pre-pandemic levels.

Here is an overview of their forecast through 2025:

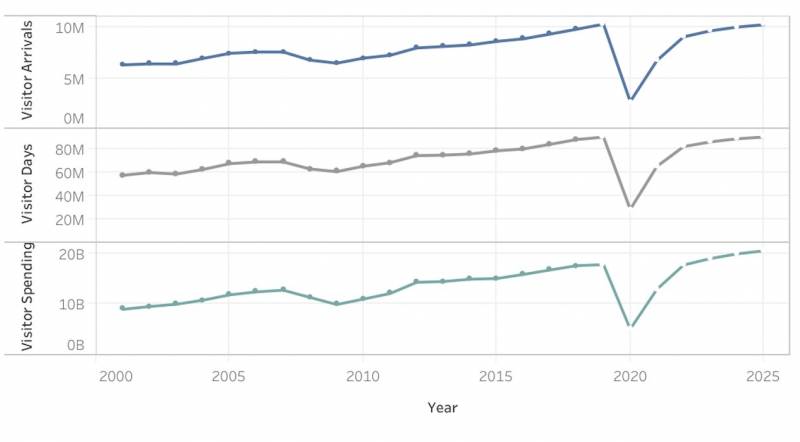

For visual learners, here’s a chart highlighting tourism activity:

You’ll notice that, according to the State of Hawai’i, we won’t return to pre-pandemic tourism numbers until 2025. With occupancy rates already very strong (75-80%) for well-managed short-term rentals, this points to continued strong demand for short-term rentals.

Supply/Demand Imbalance

The West Hawai’i market remains significantly under-supplied (less than 3mo supply) while demand remains very strong. Will some investors opt to sit on the sidelines with rates hiking? Yes, some will back out however we’d need to see a 40% reduction to Demand to even come close to a balanced market (6mo supply). For more on this topic, see an earlier post of mine: Waiting for the Market to Drop?

With stocks in a bear market, historic inflation, and the number of cash buyers still in the market, I’m not going to bet on that happening.

Big Island’s Position in State

The Big Island, specifically West Hawai’i, is positioned for continued strong growth. The opportunities I see are:

- Median sales price well below other markets

- Short-term Vacation Rental (STVR) guidelines the most accommodating across the state

- Limited new construction/expansion of resorts and hotels in West Hawai’i

- Investments into Infrastructure (widening of highways, new international terminal at airport, etc)

- Available land for responsible and respectful growth

There’s no such thing as a sure thing, and real estate investing is no exception. As many pause to find their bearings in the midst of market disruptions, be sure to seek council and rely on data to inform your decisions vs. relying on emotion, conjecture, opinion, etc.

If you’ve been considering investing in Hawai’i Real Estate, I’d love to connect and learn more about how I can best assist!

Tim O'Leary

July 8, 2022

Well explained Dave, each Hawaiian island has its beauty and there is something about the Big Island that recharges me every time I return. With higher interest rates, I’m reminded of the old adage, ‘Marry the Home, Date the Rate’. Homes are priced well still, with slightly lower demand, that can work in a Buyer’s favor. Buying the right place now is a good idea with less competition. As for interest rates, loans are temporary, lower rates will return one day & a Buyer could refinance it at that time. Thanks for sharing!