In my previous post about Warren Buffet, his [then-]recent biography The Snowball, and his investing advice to begin your snowball with wet snow, I commented that he does not invest in real estate, let alone in Hawaii real estate.

The power of free association…I started thinking about a friend of mine who was a great investor in real estate (although also not in Hawaii). Let me introduce George, expert on snow and real estate.

I first met George Vicenzi in 1977, when a man I was dating [later to become my husband] took me on a romantic getaway to visit his college fraternity buddy who lived in Aspen, Colorado. George became a dear friend and mentor about “the business of life” for over 30 years, until his unexpected death a couple of years ago.

George went to Aspen as a ski bum, before Aspen was ASPEN, so to speak. He worked as a real estate agent, and bought a little property, both residential and commercial. As Aspen grew, he spent more of his time on his other passions—hiking, climbing, skiing, and the Aspen Music Festival. As I used to say, his occupation had become “rent collector.”

George is the investor from whom I first learned about 1031 tax-deferred exchanges, as his real estate investments expanded beyond Aspen. Although passionate about life, he had a dispassionate attitude towards how he made money. “Don’t make your fun thing your work life,” he told me once as we biked up towards the Maroon Bells (he was the kind of natural athlete who could bicycle uphill at 9,000 ft and carry on a conversation the whole time). Similarly, he never let his emotional response to a property compromise his business sense.

Aside from buying in bear markets rather than in strong ones (another Warren Buffett rule!), George had two other criteria for his real estate investments. I think these should apply to investing in Hawaii real estate, because he likewise invested in island, second home, and vacation property locations (e.g. Manhattan island; Moab, Utah; and that perfect New England lighthouse). Just a reminder–if you are looking for one of the above as a home for your own use, please stop reading this blog post and return to the previous one! You are making a “fun thing” decision, not an exclusively business one.

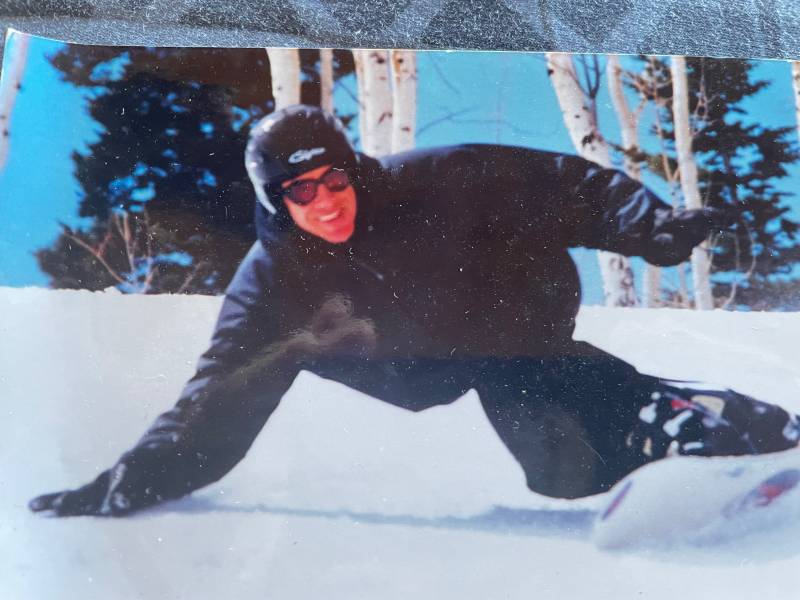

George the Snowboarderʻs Real Estate Investment Rules

The first George real estate investment rule is: among available options, buy a property that has some unique quality that won’t be easy for other competing properties to replicate in the future. In real estate appraisal terms, this is the principle of scarcity. For example, in the 1980s he was looking for an apartment on the upper west side of Manhattan. Someplace close to Lincoln Center, Carnegie Hall and the Theatre District where he could indulge his passions on twice-a-year trips. George only wanted to look at corner units with a view. In a large high rise building, most of the units will be on the interior. In a dense urban setting, at least two of the sides would likely have another skyscraper as their view. Hence within that building there would always be a scarcity value or premium for a corner unit, and a view unit, relative to the exact same floorplan in the middle. He was willing to pay that premium, knowing the scarcity factor would protect the value of his investment.

The second George real estate investment rule is: use your budget to buy a smaller property in a great neighborhood rather than a larger property in an average (or worse) neighborhood. Appraisers refer to this as the principles of regression and progression. Back to that that Manhattan investment. George could see that his chosen neighborhood had desirable characteristics, and that other savvy investors were making big plays there that would upgrade the neighborhood even further. As new exclusive buildings went up, the average price per square foot of the neighborhood would likewise progress. He bought a charming one-bedroom, renovated it perfectly, and rented it always to a single professional person for a slightly-below market rent with the specification that he could use the apartment twice a year for one week during his visits.

[deleted some examples from 2009] Whether your investment price point is $500,000 or $2 million or $7 million, with the help of a real estate agent knowledgeable about those markets, you can sift through the options pretty quickly using George’s two investment rules. And that takes us back to Warren Buffett. Wouldn’t you guess that those are exactly the properties that will get purchased first by some savvy real estate investor who has “cash and courage in a crisis”?

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.