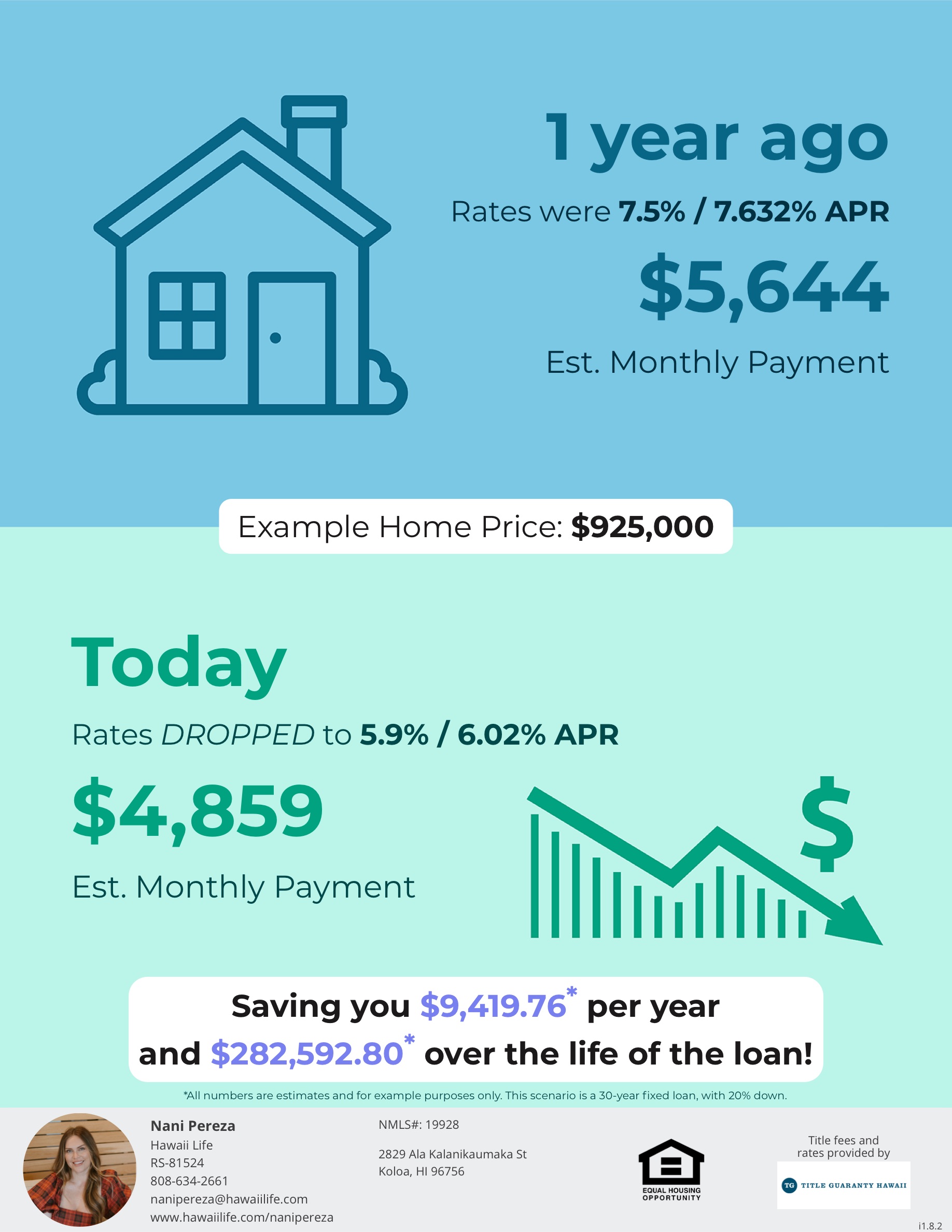

A year ago, mortgage rates hovered around 7.5%, and for a $925,000 home or condo, that translated to an estimated monthly payment of about $5,644. For many buyers, that number felt like a hard stop.

What Today’s Mortgage Rates Mean for Home Buyers

Fast forward to today, and rates have dropped to around 5.9%. On the same-priced home, the estimated monthly mortgage payment is now closer to $4,859. There are a few folks that got really lucky and scored historically low interest rates around 2020 and 2021 which we will probably not see again in our lifetime so interest rates in the 5s don’t seem so bad.

That’s a difference of about $785 per month.

Over the course of a year, that’s roughly $9,400 in savings. Over a 30-year loan, it can add up to hundreds of thousands of dollars saved in interest.

What Lower Mortgage Rates Mean for Buyers

Lower rates don’t just mean smaller monthly payments. They can also:

- Increase buying power

- Improve cash flow

- Make refinancing or upgrading more realistic

Sure, a handful of people hit the interest rate lottery in 2020 and 2021. Those historically low rates were a once in a generation moment, which makes today’s 5.9% mortgage rate feel more reasonable. For buyers who felt priced out last year, this shift could be the window they were waiting for.

What This Means for Sellers

More buyers may be coming into the picture as mortgage rates decline. Increased demand can lead to:

- More showings

- Stronger offers

- Better positioning for sellers who price strategically

According to the National Association of Realtors, changing mortgage rates play a major role in buyer demand.

The Takeaway

Timing the market perfectly is nearly impossible but understanding how rate changes impact real numbers is powerful. Even a small drop in interest rates can make a big difference in what homeownership looks like long term. Education is a powerful thing.

If you’re curious how today’s rates would affect your situation, it’s worth running the numbers. The math might surprise you. If you’re wondering how today’s mortgage rates affect your buying or selling power, I’m happy to run the numbers for your specific situation.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.