The proposed registration of Big Island hosted transient vacation rentals (TVR) — also known as short term vacation rentals (STVR) or transient accommodation rentals (TAR) or colloquially as AirBnbs — passed into law in August 2025. The bill sponsors hosted an informational webinar last week to explain what happens next.

The recorded webinar is available on the hawaiicountytar.com website for on-demand viewing. It is only about 45 minutes and about half of that is on the economic impact study rather than registration law. Since I already watched it, let me offer an updated summary of what you need to know as a current or prospective owner of a hosted short term rental.

Who Is Covered Under Big Island Vacation Rental Registration Law

The first thing to remember is that this is a process of REGISTRATION rather than the regulations proposed in previous bills aimed at hosted transient vacation rentals. You are not required to get a permit which can be granted or denied; just to register and pay the associated fees.

The reason behind registration is simple. The Economic Impact Study made it clear that the State and the County of Hawaiʻi are losing significant tax revenues they should be collecting on these rentals. Registration allows the County Department of Finance to track your revenues and tax payments.

Definitions:

Ordinance 25-50 only applies to hosted rentals, defined as a transient vacation rental located on a property that is on the principal home of a host. Unhosted rentals are required to obtain permits under previously passed legislation.

A host is defined as a “reachable person” who is on property at the same time as the rental guests, and who actually resides on the property.

A transient vacation rental is fully furnished, rented for less than 180 days, in exchange for money, goods, services or other consideration.

If you are advertising on a vacation rental platform, the assumption will be that you should be registered. The hosting platforms are required by the new law to report to the County and to show the TVRʻs state transient accommodations tax number and Hawaiʻi County registration number on their site.

Implementation of Transient Accommodations Registration

The good news is that the County needs time for the Director of Finance to get the systems in place, so the deadline for registration has been extended from the end of 2025 to (likely) 2Q 2026.

When you register, it is expected that you have a general excise tax number and a transient accommodations tax number – so if you have not been collecting or reporting those taxes, now would be the time to apply for them.

There will be future changes to the Hawaiʻi County Code to address Standards of Operation for hosted rentals. In other words, additional regulations will be promulgated similar to the standards for unhosted rentals to protect residents of neighborhoods in which the rentals are active.

Additional Implications of Registering Your TVR Business

In the Webinar, Council Member Kimball makes the analogy to the process you would go through to open a different kind of business, namely a restaurant. Your business would have to register with the Department of Commerce and Consumer Affairs, and of course you would need a General Excise Tax number. But it would be up to the County Planning and Building Departments to give you the permits for conducting that particular business – whether fast food or fine dining – in a particular building.

Hosting vacationing guests in your home is a business!

Remember – if you a renting a structure or a portion of a structure on your property that is not permitted for residential use, the Countyʻs position is that you should not have people sleeping in it. If you are not sure, check the Countyʻs online EPIC system for permits – do not rely on whether or not it is shown on the County property tax records – they will assess value for what is there, permitted or not.

If you are on agricultural zoning, you may be able to rent a room within your home as a TVR. If you have a secondary dwelling that is permitted as an additional farm dwelling, that can only be used to house workers on your ranch or farm, not to rent to vacationing guests, according to State law.

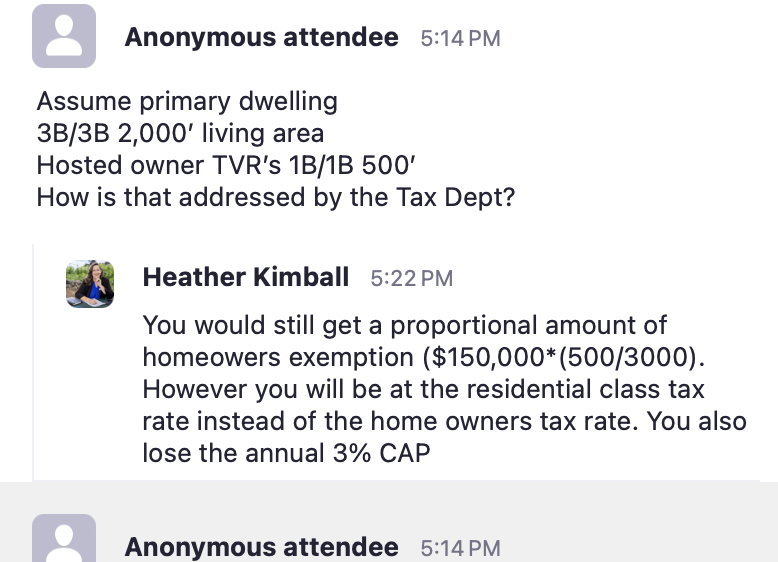

Once you are conducting vacation rental business on your property, you should expect negative property tax consequences relative to simply living in your primary residence. Here is a screenshot of an actual example in the Q&A of the Webinar:

Still Have Questions?

Feel free to subscribe to my blog posts for future updates if you are not already on my list. Or let me know if there is a question I can answer right now.

Mbk

November 5, 2025

Thanks for simplifying this. And if I understand it correctly, if I have an established STVR, that is not my residence, with a current permit and I pay all taxes then there is no change for me. It’s correct as is and I just continue to renew my permit and pay state and county taxes as usual? Thanks for helping me stay honest!